An Introduction to Break-even

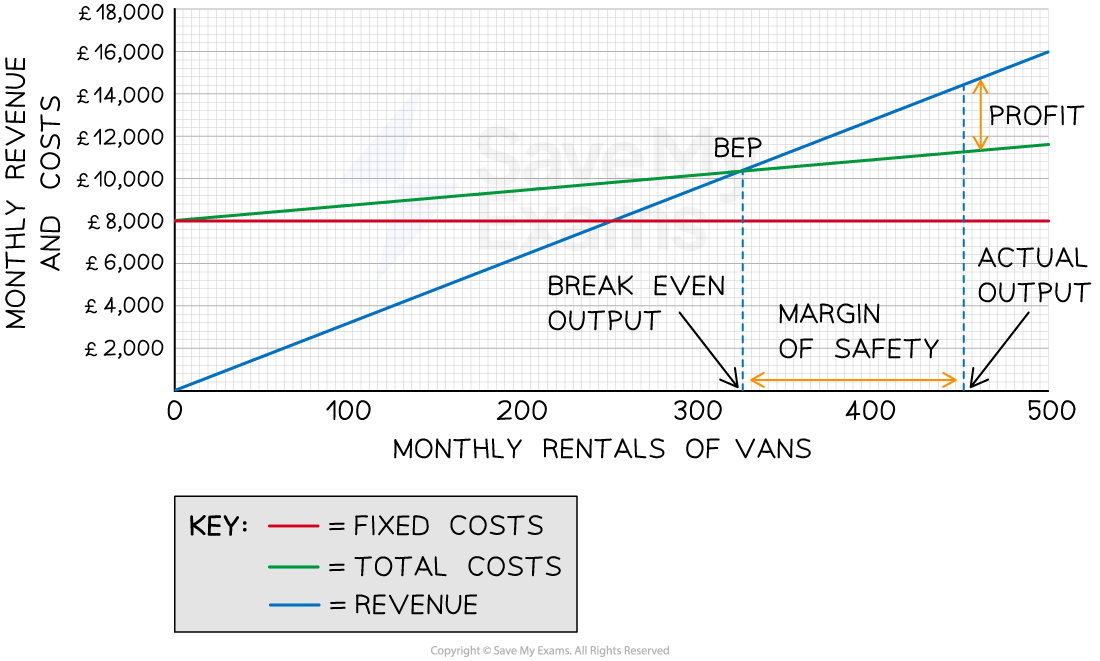

- Break-even analysis is a financial tool used to determine the number of units a business must sell to reach the point where the business revenue equals its expenses (no profit nor loss)

- It helps businesses understand the minimum level of sales or output they need to achieve in order to cover all costs

- This helps business managers to make informed decisions about pricing and production volumes

- The break-even point is the number of units that need to be sold for total costs to equal the sales revenue

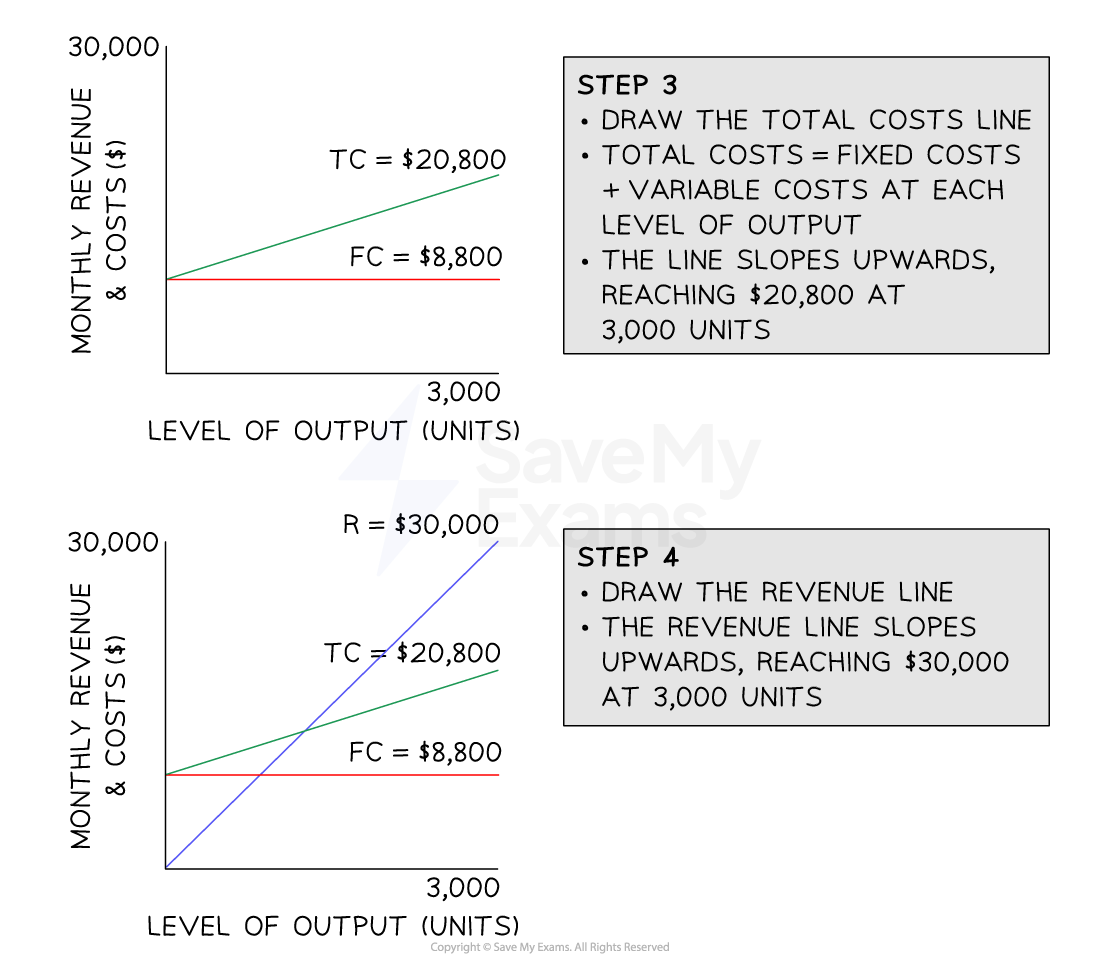

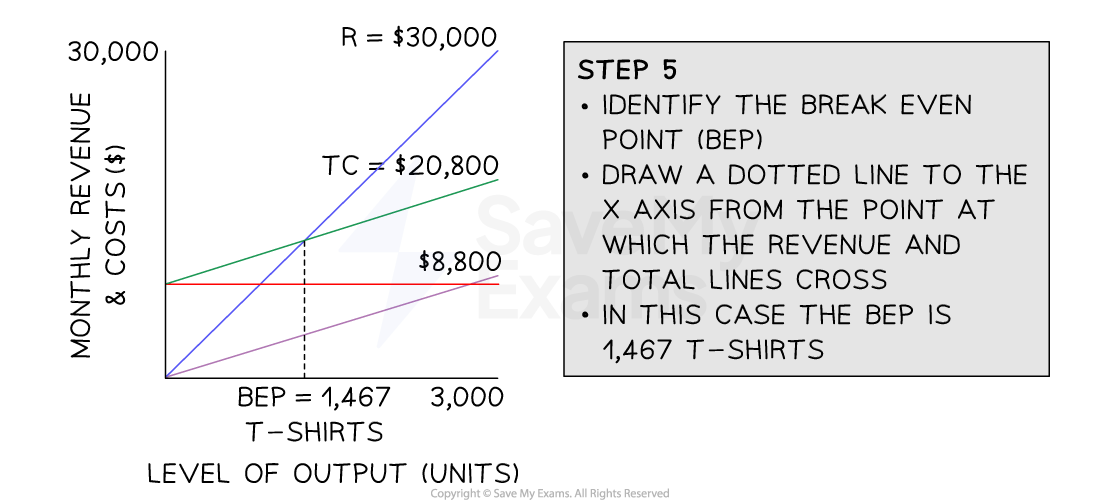

Diagram with the Elements of a Break-even Analysis

Variable costs, fixed costs and sales revenue are all used in calculating the break-even point

- Fixed costs are costs that do not change regardless of the level of production or sales

- E.g. rent, salaries and insurance

- E.g. rent, salaries and insurance

- Variable costs are costs that vary with the level of production or sales

- E.g. raw materials, direct labour costs, packaging and shipping costs

- E.g. raw materials, direct labour costs, packaging and shipping costs

- Sales revenue is the money gained from selling products/service and is calculated as follows

- Sales revenue = number of items sold x selling price