Inflation, Deflation & Disinflation

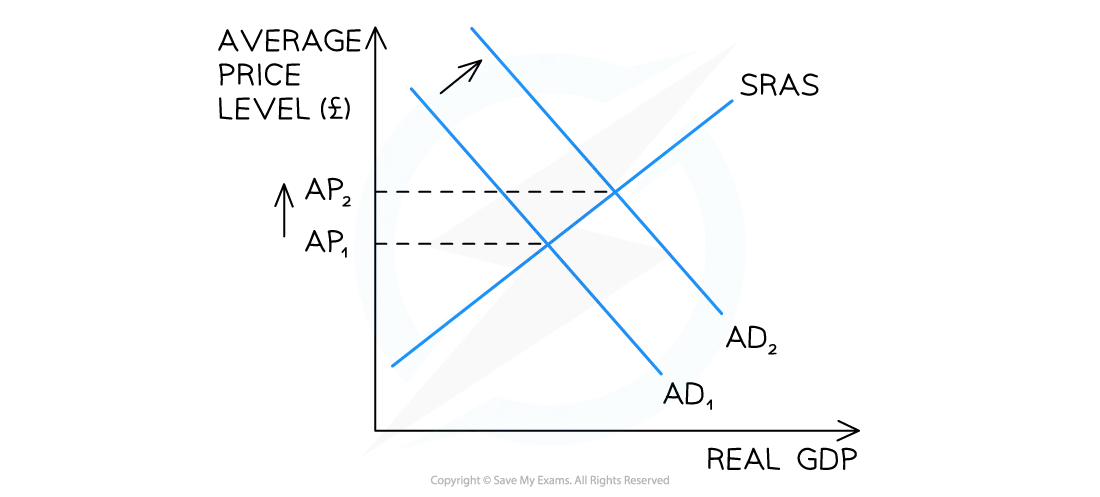

- Inflation is the sustained increase in the average price level of goods/services in an economy

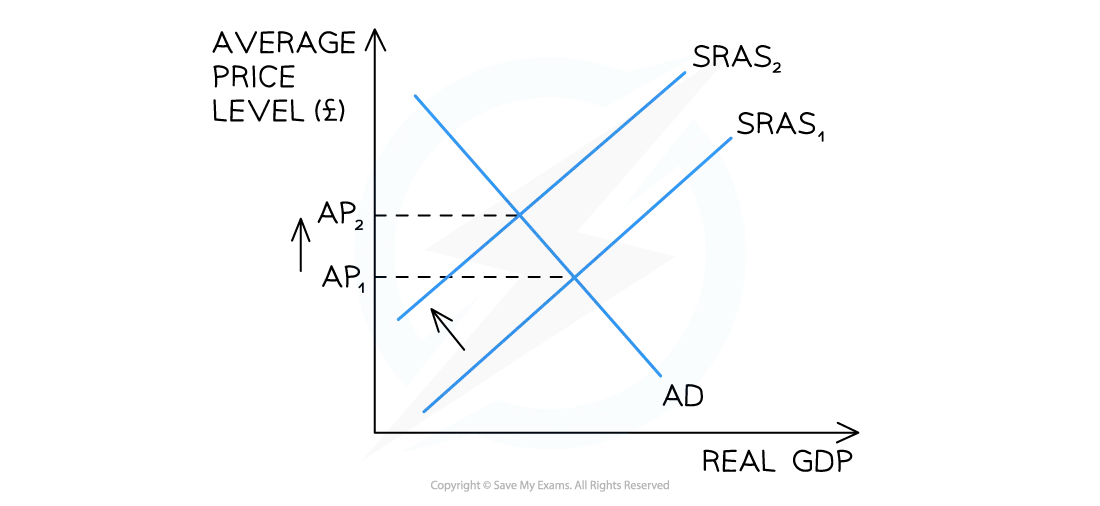

- Deflation occurs when there is a fall in the average price level of goods/services in an economy

- Deflation only occurs when the percentage change in prices falls below zero %

- Deflation only occurs when the percentage change in prices falls below zero %

- Disinflation occurs when the average price level increases but at a decreasing rate than before

- These figures demonstrate disinflation: Y1 = 5% Y2 = 4% Y3 = 2%

Diagram: UK Inflation, Disinflation and Deflation

Between 2013 and 2015, the UK experienced disinflation, with inflation falling from 3.5% to just on 0%. From 2021, it experienced sustained inflation, rising to 4.2%